irvine income tax rate

And its top marginal income tax rate of 123 is the highest state income tax rate in the country. Everything from groceries gas prices.

Self Employed People Can Get A Great Home Loan Home Loans Mortgage Loans Loan

California state sales tax.

. The state depends on property tax income a lot. The combined rate used in this calculator 775 is the result of the California state rate 6 the 92618s county rate 025 and in some case special rate 15. 175 lower than the maximum sales tax in CA.

This includes the following. The combined Irvine sales tax is 775. This is similar to the federal income tax system.

- Tax Rates can have a big impact when Comparing Cost of Living. In all there are 10 official income tax brackets in California with rates ranging from as low as 1 up to 133. The 2018 United States Supreme Court decision in South Dakota v.

About our Cost of Living Index. Above 100 means more expensive. See reviews photos directions phone numbers and more for the best Tax Return Preparation-Business in Irvine CA.

There is an additional 1 tax on taxable income over 1 million for mental health services. Orange County sales tax. Income and Salaries for Irvine - The average income of a Irvine resident is 43456 a year.

If you have questions you can contact the Franchise Tax Boards tax help line at 1-800-852-5711 or the automated tax service line at 1-800-338-0505. Sales Tax in Irvine CA. Free Tax Filing Wednesdays February 2 April 6 The City of Irvine in partnership with Orange County United Way OCUW is offering free tax preparation services to taxpayers who earned less than 60000 in 2021.

A combined city and county sales tax rate of 175 on top of Californias 6 base makes Irvine one of the more expensive cities to shop in with 1117. You can print a 775 sales tax table here. The California sales tax rate is currently.

The US average is. The latest sales tax rate for Irvine CA. Irvine Sales Tax Rate.

The minimum combined 2022 sales tax rate for Irvine California is. The County sales tax rate is. Find a local Irvine California Income Tax attorney near you.

The Irvine sales tax rate is. Technically tax brackets end at 123 and there is a 1 tax on personal income over 1 million. Expect to pay between 1715 in rent for a studio or 3672 for a 4-bedroom.

2020 rates included for use while preparing your income tax deduction. The Irvine sales tax rate is. This rate includes any state county city and local sales taxes.

- The Income Tax Rate for Irvine is 93. The 92618 Irvine California general sales tax rate is 775. Wayfair Inc affect California.

Qualifying taxpayers who live work or attend school in Irvine can receive help filing their taxes from IRS-trained and certified volunteers who will also assist. All other budgetary categories such as policefire hospitals recreation transportation and. In establishing its tax rate Irvine must comply with the California Constitution.

100 US Average. Did South Dakota v. What is the sales tax rate in Irvine California.

The 775 sales tax rate in Irvine consists of 6 California state sales tax 025 Orange County sales tax and 15 Special tax. Actually rates cant be increased until after Irvine provides notice of its intention to contemplate an increase. The US average is 28555 a year.

- The Median household income of a Irvine resident is 91999 a year. This is the total of state county and city sales tax rates. And its top marginal income tax rate of 123 is the highest state income tax rate in the country.

This is the total of state county and city sales tax rates. The minimum combined 2022 sales tax rate for Irvine Florida is. For tax rates in other cities see California sales taxes by city and county.

The average Income Tax Auditor salary in Irvine California is 69059 as of November 29 2021 but the salary range typically falls between 58266 and 81048. Did South Dakota v. Wayfair Inc affect Florida.

The property tax rate is higher than the average property tax rate in California which is 073. While the State of California only charges a 6 sales tax theres also a state mandated 125 local rate bringing the minimum sales tax rate in the state up to 725. The US average is 46.

The state of Californias income tax rate is 1 to 123 the highest in the US. Below 100 means cheaper than the US average. Taxes in Irvine California are 102 more expensive than Brea California.

The average household income in Irvine CA is 91999 and a single resident has an average income of 43456. There is no applicable city tax. Additionally taxpayers earning over 1M are subject to an additional surtax of 1 making the effective maximum tax rate 133 on income over 1 million.

The County sales tax rate is. The Florida sales tax rate is currently.

What Are California S Income Tax Brackets Rjs Law Tax Attorney

Calif Business Owners Pay Highest Income Tax Rate Orange County Register

Harp 2 Fannie Mae Owned Properties Mortgage Payoff Refinancing Mortgage Mortgage Interest Rates

Tips You Can Do To Save Money On Your Income Tax Fbc Tax Write Offs Home Based Business Investing

Non Prime Financing 500 Fico 1 Day Out Of Bankruptcy Foreclosure Or Short Sale Bank Statement Program Availab Commercial Loans Usda Loan Mortgage Companies

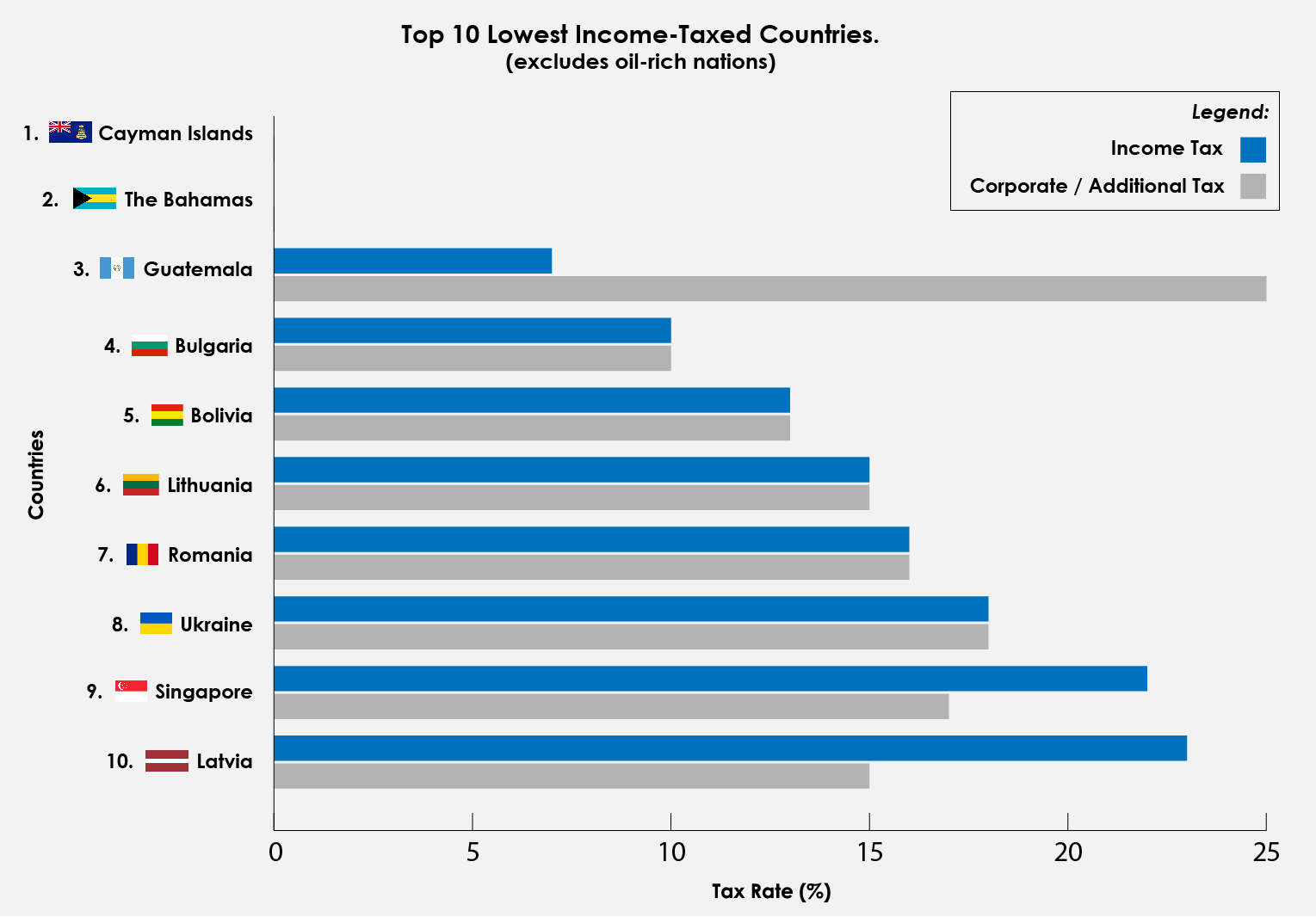

Does Lower Income Tax Make A Happier Country

Personal Income Tax Revenues As Percent Of Gdp And Of Total Revenues Download Table

Tax Rates And Income Brackets For 2020

Winter 2021 Canadian Income Tax Highlights Cardinal Point Wealth Management

Realtymonks One Stop Real Estate Blog Tax Attorney Property Tax Tax

The Rise Of The Non Working Rich Capital Gains Tax Wealth Transfer Estate Tax

Ways To Save On Home Expenses Money Savvy Ways To Save Money Mindset

Pmc Fha 580 Fico 43 47 Debt To Income Ratio Can Be Combined With Down Payment Assistance Fha Loans Mortgage Help Mortgage Companies

Understanding California S Property Taxes

Filing Taxes In 2021 Filing Taxes Tax Attorney Tax Time

Why Households Need 300 000 To Live A Middle Class Lifestyle

Why Households Need 300 000 To Live A Middle Class Lifestyle